An Interview with Janet Hanson on Her Career Journey with Goldman Sachs

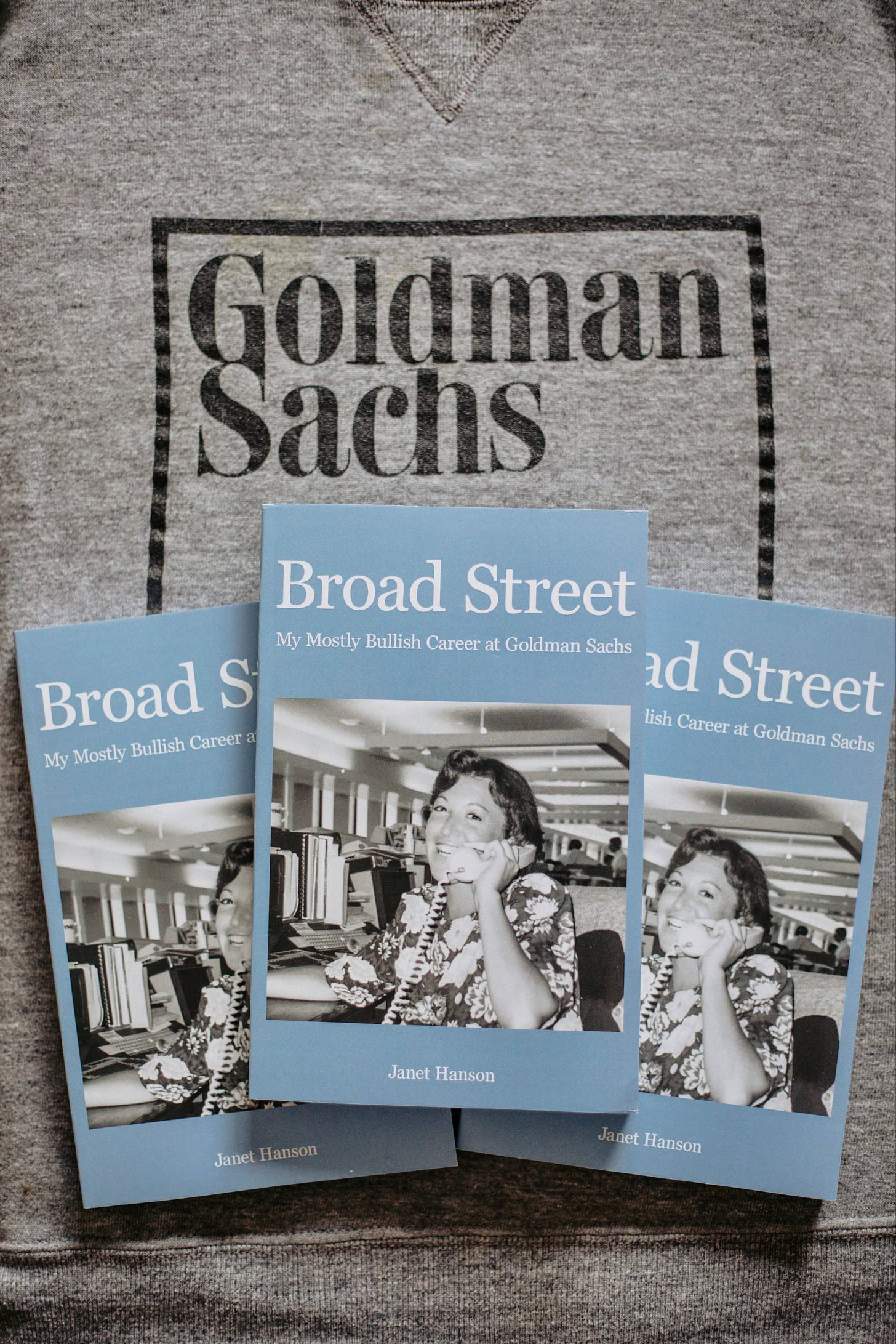

Janet Hanson, a prominent figure in finance and a staunch advocate for women's empowerment, shares her remarkable journey in her memoir, "Broad Street: My Mostly Bullish Career at Goldman Sachs" A former Goldman Sachs associate turned Founder and CEO, Hanson's narrative traces her rise from Wall Street newcomer to the establishment of 85 Broads, an independent global alumni network designed to empower and connect women who had traversed the halls of Goldman Sachs. The network swiftly burgeoned into a global force, uniting over 30,000 pioneering women across diverse professional trajectories

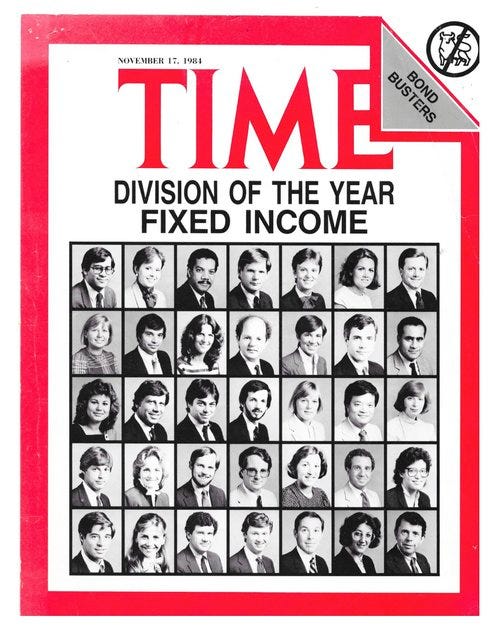

Janet's story begins with a pivotal encounter with John Whitehead, a senior partner at Goldman Sachs, whose encouragement spurred her to pursue business education and ultimately join the firm. Despite initial hesitations, Hanson's tenure at Goldman Sachs was marked by her exceptional performance, culminating in her historic promotion as the firm's first female sales manager.

However, the corridors of Wall Street weren't devoid of challenges for Janet. As she scaled the professional ladder, she encountered personal setbacks and the daunting reality of confronting both metaphorical walls and glass ceilings. Yet, undeterred by adversities, Hanson's resilience propelled her towards a pivotal juncture in her career - the founding of Milestone Capital in 1994, a venture that burgeoned into a $3 billion asset management firm.

Readers have praised "Broad Street" for its candid portrayal of Hanson's challenges and triumphs. The memoir resonates with individuals seeking inspiration and guidance in their career pursuits. "Broad Street" not only chronicles Hanson's professional trajectory but also serves as a manifesto for women aspiring to carve their niche in finance. Interwoven with anecdotes and insights, Hanson elucidates the importance of resilience, mentorship, and forging meaningful connections in navigating the complex terrains of Wall Street.

In a recent conversation with Janet Hanson, she reflected on her journey and the process of writing "Broad Street." With characteristic candor and insight, Hanson shared her experiences, offering invaluable lessons and perspectives on entrepreneurship, leadership, and the power of perseverance.

Excerpts from the Interview:-

Q1) Janet, your journey from meeting John Whitehead on a chartered sailboat to becoming one of the most respected sales managers at Goldman Sachs is truly remarkable. Could you share with us a pivotal moment or experience from your early days at Goldman Sachs that shaped your career trajectory and inspired you to eventually write "Broad Street: My Mostly Bullish Career at Goldman Sachs"?

Janet: A pivotal moment early in my career was when I realized how hard it was going to be to earn the trust and respect of my accounts before they did any meaningful business with me. My colleagues had accounts who did very large trades with the firm which made “learning the ropes” that much more humbling and at times, deflating. What I learned during my first year on the desk was the patience and discipline to really listen to my clients, even if they didn’t buy a single security from me. I was ultimately rewarded when one of the smallest accounts I covered put in a very large order to buy bonds in a deal the firm was underwriting for Ford Motor. From that moment on, I knew I had the tenacity and the intelligence to be part of the team.

Q2) Your book has been praised for its candid portrayal of the challenges and triumphs you faced as a woman in the male-dominated world of finance. Can you elaborate on some of the key obstacles you encountered along the way, and how you navigated them to achieve success?

Janet: In the early years, there were few, if any, obstacles in my way because my accounts were “gender blind” and the few women on the trading floor were not perceived as a threat to the firm’s male hierarchy. It wasn’t until an anonymous group of current and former GS women threatened a class-action lawsuit that management grew alarmed (if not downright paranoid) as they wondered if their female colleagues were “co-conspirators.” Just the threat of a lawsuit was enough to damage the rapport that had gradually developed over the years between senior men and women at the firm. I tried to neutralize the damage by holding the first women’s conference in the firm’s history which was perceived by management as a great success. Unfortunately, the dye was cast and for that reason, I eventually exited the firm to start my own mutual fund company.

Q3) "Broad Street" not only delves into your experiences at Goldman Sachs but also chronicles your journey in launching your own wildly successful asset management firm. What motivated you to leap into entrepreneurship, and how did your time at Goldman Sachs prepare you for this new chapter in your career?

Janet: The decision to become an entrepreneur was an easy one because in so many ways, I had run my own book of business in my first 11 years at Goldman Sachs. The problem, however, was that “the house” had complete control over what I would be compensated for the revenues I delivered to their bottom line. When I raised over $1 billion in net new assets for Goldman’s fixed income mutual funds on my return to the firm in 1991, I realized that I would rather raise assets for my own firm and have 100% control over my compensation. That turned out to be a very wise decision.

Q4) One reader review highlighted your resilience and ability to persevere through tough times, which is evident throughout your memoir. Could you share with us a specific instance where your determination was put to the test, and how you managed to overcome adversity?

Janet: The decision to stay at the firm after I had been turned down for a management position that no one else was vying for was an enormous test of my intestinal fortitude and resilience. It was humiliating to be told that I wasn’t being promoted because I had “panicked during an earthquake and was not management material because I lacked the ability to remain calm under pressure.” I decided to prove that I had the right stuff by taking on more responsibility and as importantly, I became one of the highest revenue producers in the division.

Q5) Your commitment to empowering women is evident in your creation of 85 Broads, an elite network of GS alumni that later expanded to include several colleges. How do you believe initiatives like 85 Broads contribute to breaking down barriers for women in finance and fostering a more inclusive professional environment?

Janet: As the CEO of Milestone Capital, one of the only mutual fund companies owned and managed by a woman, I was frequently asked to speak to women at the top graduate and undergraduate schools. The more time I spent on campus getting to know these exceptionally smart women, the more I encouraged them to think about Wall Street as a career path. These women had all of the attributes of their male counterparts – they had won math and science awards in high school, many were incredible athletes, and all of them were whip smart. In every speech I gave, I passionately opined about my life on the Goldman Sachs trading floor and later, as the CEO of a multi-billion dollar asset management company. I am proud to say that many of the women I met on those campuses went on to have brilliant careers at the top investment banks, at premier private equity firms, and at many of the biggest hedge funds.

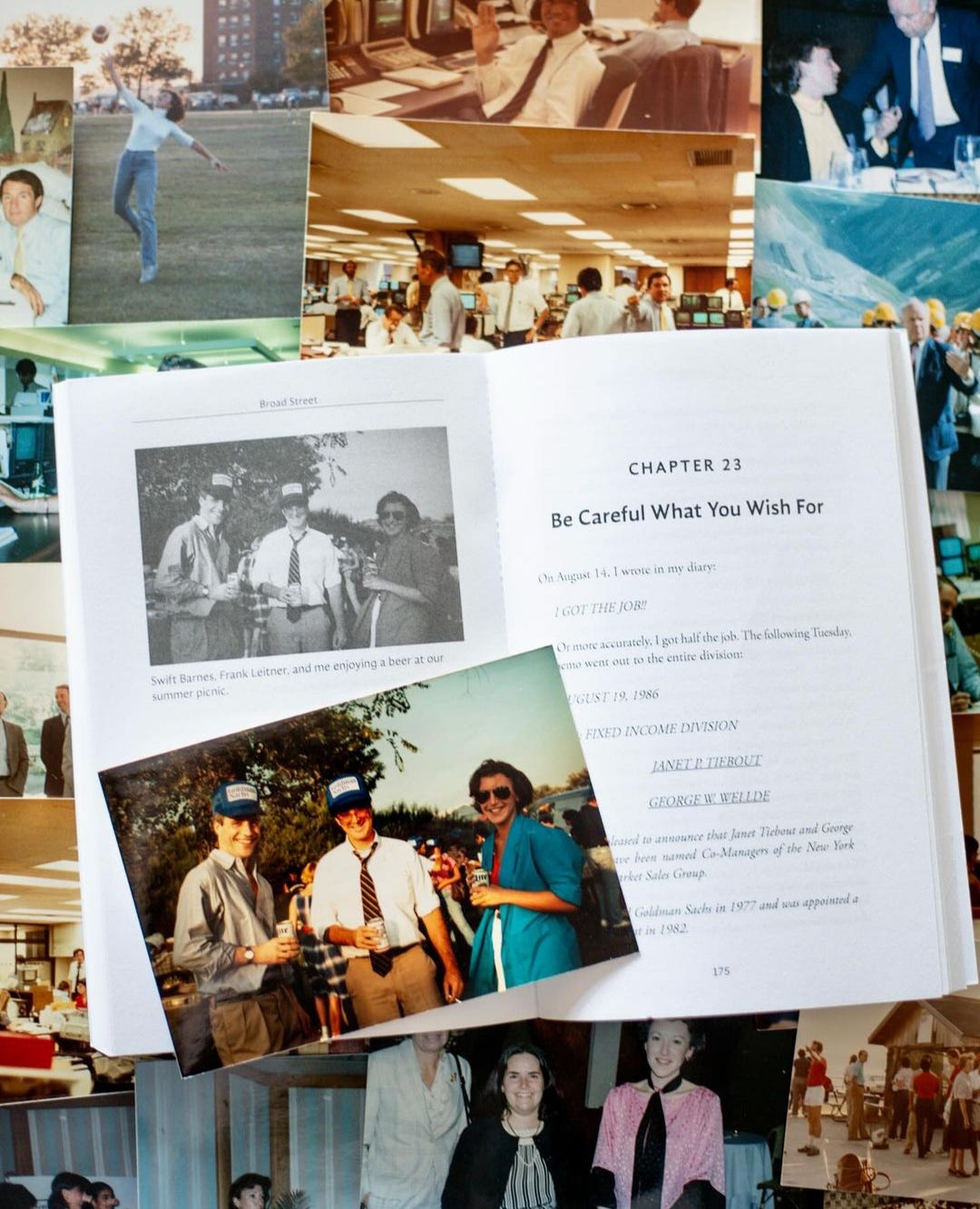

Q6) The reviews of your book often mention its intelligent, vivid, and authentic writing style. Can you tell us about your process of writing "Broad Street" and any challenges you faced in recounting your career experiences with such honesty and clarity?

Janet: I was a history buff and as such, I knew I was part of history in the making as one of the very few women associates at Goldman Sachs. For that reason, I kept every letter and memorandum I received when I was at the firm because I knew the day would come when I would write about my experience. My only sadness is that I didn’t write my book sooner. It would have been the female version of Liar’s Poker which Michael Lewis wrote shortly after he exited Salomon Brothers.

Q7) Your memoir touches on the importance of building coalitions and navigating the complexities of corporate environments. What advice would you give to aspiring leaders, particularly women, who are striving to advance their careers in competitive industries like finance?

Janet: One of my fondest expressions has always been “information is power.” If I wasn’t at work or out with clients, I was reading every newspaper and magazine article I could find about the industry I worked in. Being solidly up the learning curve gave me a conversational edge with my superiors and with my clients. As importantly, I learned the art of diplomacy at a very early age – it was never lost on me that I could earn a person’s respect if I was viewed as a trustworthy ally. If you want to be a leader, you have to act like one. Over time, perception becomes reality.

Q8) In your book, you discuss the significance of investing in other women and the impact it has had on shaping your career. Can you share a specific example of how mentoring or supporting other women has made a difference in your professional journey?

Janet: As the founder of 85 Broads, I met the most extraordinary women, many of whom were still in their teens in college. Alexa von Tobel, a junior at Harvard, interned at Milestone Capital during the summer of 2005, along with a dozen other women. That summer we started a company called MarketClout. Our mission was simple: get young women to recognize that their savvy as consumers made them equally savvy investors. Our tag line was “invest in what you love.” I put $75,000 in a Fidelity account and each one of the interns bought shares of stock in companies whose brands they loved. That fall, we took the MarketClout message to colleges across the US. After Alexa graduated from Harvard, she launched LearnVest, a company designed to teach young people the basic principles of investing. I was one of Alexa’s earliest backers, along with two ex-GS women partners. In 2015, LearnVest was acquired by Northwestern Mutual for several hundred million dollars. Alexa now runs her own venture capital firm and is, without doubt, one of the most successful entrepreneurs of her generation.

Q9) As someone who has been a trailblazer in finance and entrepreneurship, what do you hope readers will take away from "Broad Street" in terms of lessons learned or inspiration gained?

Janet: There’s an old Wall Street saying is that if you believe your career has foundered, you should “mark yourself to market.” Bottom line, you have to find out if you’re worth more “on the outside.” Because very few people ever left Goldman Sachs to work for a competitor, it was virtually impossible to know if there was a “better bid away.” I returned to Goldman in 1991 for one reason – we needed the money. What I didn’t appreciate at the time was that even though I hated working in the one division that no one at the firm cared about (asset management) I grabbed the chance to learn everything I could about the mutual fund industry. When my career completely flatlined in 1993, Jeff and I made the decision to launch Milestone Capital because I had learned from the best and knew if we worked 24/7 that we had a real shot at beating Goldman at their own game. An even shrewder move was to launch Milestone as the first women-owned institutional money market fund company in the US. Because we had such low overhead, our business was profitable within two years. After that, it was a moonshot.

Q10) Looking back on your career, what do you consider to be your proudest achievement or most rewarding moment, and why?

Janet: Hands down, one of my proudest achievements was founding 85 Broads and the media attention we garnered as a result. In October, 1999, Reed Abelson wrote an amazing piece about the network that landed on the front page of The New York Times Business Section. The title of Reed’s piece was: “A Network of Their Own: From an Exclusive Address, a Group for Women Only.” Goldman’s top brass were truly astonished to read about a network for, and run by, current and former female GS employees that the firm itself didn’t have control over. Our ability to “end run” the system (in the most respectful way) and our collective, somewhat giddy feeling of independence from “the mother ship” was a moment I will never forget. 85 Broads went on to become the most powerful corporate alumnae network of its kind and to this day, has helped thousands of women from all over the globe define success on their own terms.

Thank you all for reading and a big thanks to Janet Hanson for collaborating in today’s post!

It’s a pleasure!