Quantum Economics : An Interview with David Orrell — Writer and Mathematician

ABOUT THE AUTHOR

ABOUT THE AUTHOR

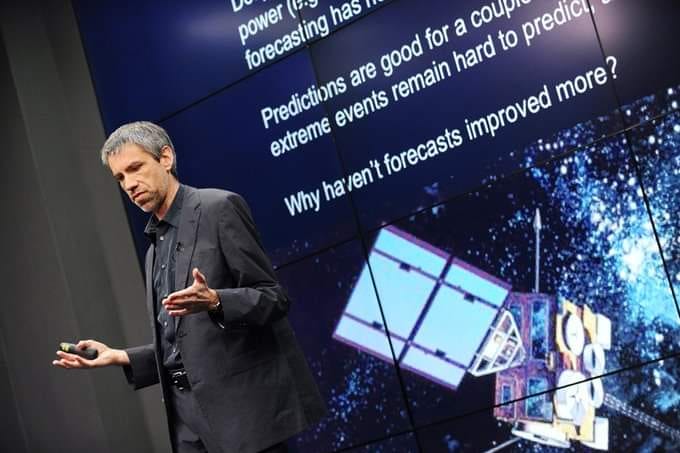

David Orrell, Ph.D. is a scientist and author of Popular Science Books. He has majored in Mathematics at the University of Alberta , and obtained his D.Phil(Mathematics) from Oxford University on the prediction of nonlinear systems.

His work in mathematical modeling and complex systems research has led him to multiple domains such as weather forecasting, particle accelerator design, economics, and cancer biology.

David Orrell

David John Orrell (born 1962 in Edmonton) is a Canadian writer and mathematician. He received his doctorate in…en.wikipedia.org

David Orrell | Writer and Mathematician

I am a native of Edmonton, Canada, and studied mathematics at the University of Alberta. After several years working on…www.postpythagorean.com

He is the author of EconoMYTHS : 11 Ways Economics Gets It Wrong and The Other Side of the Coin: The Emerging Vision of Economics and Our Place in The World about new economic theories; and Apollo’s Arrow : The Science of Prediction and The Future of Everything about prediction in weather, genetics, and economics, which was a national bestseller and finalist for the Canadian Science Writers’ Association book award.

Economyths

Economyths is a book by the mathematician David Orrell about the problems with mainstream economics, written for the…en.wikipedia.org

David Orrell | Writer and Mathematician

Publisher's synopsis The national bestseller that takes a new look at looking at the future. From seers to scientists…www.postpythagorean.com

His work has been featured in print media such as New Scientist and The Financial Times. He has spoken at many conferences & events including the Art Center Global Dialogues on Disruptive Thinking. He currently lives in Toronto (Canada) where he runs a mathematical consultancy , Systems Forecasting as a Principal Consultant.

Systems Forecasting | LinkedIn

Systems Forecasting | 12 followers on LinkedIn | Systems Forecasting is a scientific consultancy. We specialise in…www.linkedin.com

Does economics need a quantum revolution?

In the beginning of the 20th century, physicists began to observe some disturbing changes. When you get to the level of subatomic particles, the classical rules of motion and even logic start to break down.

Electrons disappear into the void, immediately reappearing somewhere else. They get intertwine with each other.

The physics fraternity followed the evidence or facts and quantum theory was born. David thinks that it’s high time economics did the same.

Helpful Behavioral Economics Concepts for the Business-Minded | Data Driven Investor

In corporate America, Gaussian statistics, deterministic interpretations of the world around us, and rational…www.datadriveninvestor.com

In his book Quantum Economics: The New Science of Money, he asserts that conventional economic models completely misunderstand the importance of money which, he believes, has quantum properties. I had an insightful conversation and Q&A session with him in which he explained his theories and viewpoints.

Excerpts from the Interview :-

Q1) What inspired you to build your career in Economics and Applied Mathematics? Briefly tell our readers here about your journey.

David Orrell | Writer and Mathematician

Read reviews Publisher's synopsis Economyths upends the basic tenets of economic thought, and points the way to a new…www.postpythagorean.com

David : This was really through my books. I became interested in economics when researching a chapter on economic predictions for my 2007 book The Future of Everything.

The Future of Everything

The title of this book is a little over-reaching, since it mostly just discusses the prediction of weather, the…www.goodreads.com

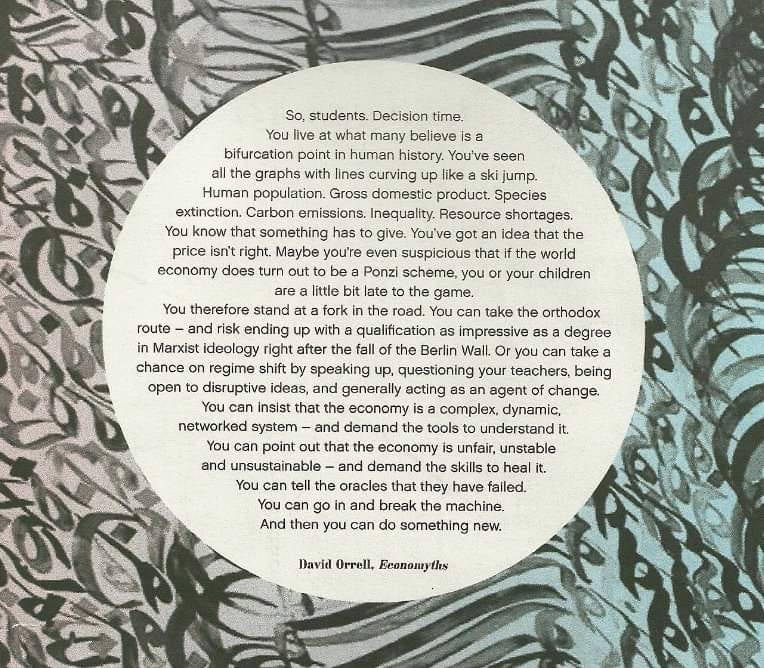

Economyths (2010) was written in part as a response to the 2007/8 crash. While researching The Evolution of the Money, I hit upon this idea that money is best described as a quantum phenomenon, in the sense that it can be modelled using the same type of mathematics. Since then I have focussed mostly on writing both technical and popular-audience works on quantum economics. These draw on the areas of quantum social science and quantum finance , as well as my own research.

David Orrell | Writer and Mathematician

Related research articles Quantum-tative Finance, Wilmott Magazine, March 2020. The value of value: a quantum approach…www.postpythagorean.com

Over the last few years there has been a real pickup in quantum approaches in areas ranging from international relations to finance, in part because of the excitement around quantum computing.

Q2) 2008 Global Financial Crisis has proved that contemporary main-stream theory is not adequate for practical life. The economic crisis made the problems visible and easier to understand, and these problems are treated as extremes, irregularities within the existing economic paradigm. Should we wonder whether these are the couriers of some new economic paradigm? Or is it just an expression of the need for one completely new view on the world and the new view on economic dimension of that world? Do you think that the foundations of economics are rotten? If yes, then why?

David : To start with the last part, it is certainly fair to say (and many have) that the foundations of economics are in poor shape. Adam Smith and later the neoclassical economists thought they were following a Newtonian approach, but I think a better comparison is to Aristotelian physics. The main assumption of mainstream economics is that the system is driven to equilibrium, and nothing moves unless it is pushed by some external force (e.g. “exogenous shocks”). The same idea is seen with efficient market theory in finance, or the general stochastic dynamic equilibrium (DSGE) models used in macroeconomics. Change is assumed to happen instantaneously, though DSGE models include various “frictions”. However there is no real concept of forces or masses, as in Newtonian physics. So economics is stuck in a very primitive modelling framework. There is a definite need for a new paradigm, and I think the way to get to it is by focusing on the topic of money, which has been largely neglected, in part because it doesn’t fit with the mainstream approach.

Q3) Could we predict crises with quantum theories fuelled by physics? What could be the tools to prevent a recession based on your research?

David : For complex systems, the best you can do is hope for pockets of predictability. For example, a main part of my applied mathematics career has been using mathematical models to predict the effect of anti-cancer drugs in experiments, which works because it is a very controlled situation. If someone tries an experiment with a brand new drug, it is much harder to make a useful prediction. And predicting an adverse reaction such as a stroke is of course even harder. The economy doesn’t allow for a lot of controlled experiments, however there are pockets of predictability, for example patterns in option prices. It is hard to predict the timing of a crash or recession, but it is possible to say something about the risk in the first place. I don’t think a quantum approach is necessary for this, but it certainly helps by e.g. drawing attention to the dynamics of debt. One of the main reasons neoclassical economists didn’t predict the 2007/8 crisis was because the financial sector wasn’t included in macroeconomic models.

Q4) How can quantum concepts be applied to money? Why is money dual?

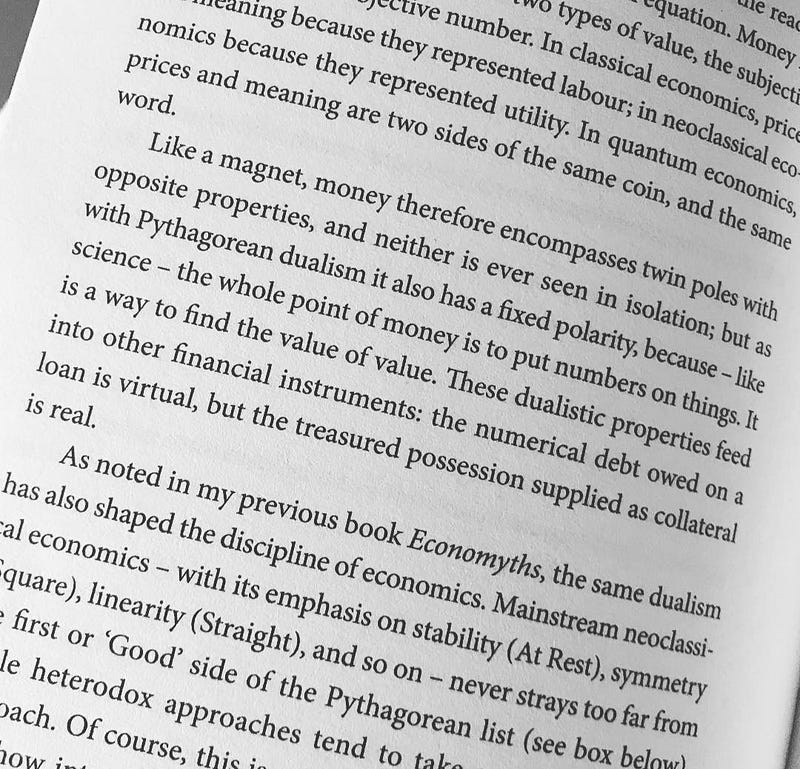

David : People often talk about the “magic of money” because it has remarkable properties — for example it can change form, it can jump from one place to another, it can be created out of nothing or vanish in a flash. But I would say that money only appears magical because it has properties which are confounding from a classical perspective. It makes much more sense when viewed from a quantum approach. For example, a key idea in the quantum approach is that entities can appear and disappear, and this is handled by so-called creation and annihilation operators. More important though is the idea of wave function collapse, which in economics corresponds to the measurement of price through a transaction. Money is dual because it does this trick of collapsing our subjective ideas about value to an objective number.

Q5) Why economists can’t predict the future?

David : One problem is that mainstream economists start with the idea that they can’t predict the future, because markets are efficient and price changes are random. Another as mentioned above is that prediction is hard. But as I noted in the Quantum Economics book, many heterodox economists did predict the 2007/8 crisis, because they were more alert to the dynamics of credit.

Q6) What, in your opinion, is the most important quality in an Economist?

David : Humility. The economy is a complex system, and our models are like patches which capture some aspect of this system. During the crisis, a lot of harm was done by models which ascribed a false degree of confidence to e.g. the value of a derivative.

Q7) The quantum revolution was born when physicists found that at the subatomic level energy was always exchanged in terms of discrete parcels, which they called quanta. In economics, the equivalent would be exchanges of money. The money objects we use in exchange, such as coins, might not seem to resemble subatomic objects. According to you what are the common elements in the fields of economics and quantum physics?

David : Instead of quantum physics, I would prefer to say quantum mathematics. The main difference between quantum and classical approaches is that they measure probability in a different way, and the quantum approach can handle things like interference. As computer scientist Scott Aaronson notes, quantum methods are adapted to handle “information and probabilities and observables, and how they relate to each other” which applies as well to economics as it does to physics. For example, transactions are inherently probabilistic, and if you build a probabilistic model of supply and demand it leads naturally to a quantum model. Money is also a social technology, so it depends on cognitive effects (including interference between incompatible concepts) which are often best handled using a quantum approach. My latest book Quantum Economics and Finance: An Applied Mathematics Introduction gets into the mathematics:

Quantum Economics and Finance by David Orrell

The word "quantum" is from the Latin for "how much" and in this book mathematician David Orrell shows how it applies to…pandaohana.com

The reason neoclassical economics has been so influential is because it is not just an analogy for how we behave, but a mathematical model, and I would say the same of the quantum approach — it is not just a metaphor or an analogy (though that is part of the picture) but instead is a mathematical framework for understanding money and financial transactions.

Q8) Basic economic concepts (Pareto optimality, rationality, Nash equilibrium) are mainstream economics. According to you why economics should do all of the following: look beyond homo economicus, run more Behavioral experiments, use more agent-based modelling, study disequilibrium behaviour, focus more on money, introduce complexity theory, use less mathematics, include quantum theory, have fewer equations. Why economics needs a paradigm change or different approach from neoclassical economics? Based on your research, can you give some comparison points between Quantum Economics and Neoclassical Economics?

David : As an applied mathematician, I am OK with equations when used in moderation but they shouldn’t be viewed as an end in themselves, which is why I always go back and forth between the math and the written description. To compare economics and physics: physics progressed from Aristotelian equilbrium, to Newtonian dynamics, to quantum physics. Economics got stuck in the Aristotelian stage because it couldn’t come up with the right dynamical framework. Things like game theory or rational economic man are used to justify this approach. Adjustments such as behavioural economics are a bit like the epicycles used by the ancient astronomers to make their models seem more realistic, without changing the basic framework. An interesting feature of the quantum economics approach is that it leads naturally to economic versions of things like mass and force. So I think economics has to jump to the quantum stage.

In economics, the most basic difference between the quantum approach and the mainstream approach is that the latter thinks in terms of barter, while the former starts with the concept of money. In the quantum view, money is a social technology which is used to attach numbers (prices) to the fuzzy concept of value. This process can be captured using the mathematics of wave function collapse. If you follow that thread, it leads naturally to things like dynamics, entanglement, and indeterminacy, instead of equilibrium, independence, and rationality as in the neoclassical approach.

Thank you all for reading and a big thanks to David Orrell for collaborating in today’s post!

It’s a pleasure!