India's Economic Architects : Chronicle of Finance Ministers' Legacy - A Conversation with A.K. Bhattacharya (Editorial Director at Business Standard)

A.K. Bhattacharya, popularly known as AKB in journalistic circles, stands as a stalwart in Indian business journalism, with a career spanning over four decades. Beginning his journey during the tumultuous early 1990s, he witnessed firsthand the dramatic economic reforms that reshaped India’s trajectory. From his pivotal role at the Economic Times to his editorship at The Pioneer and Business Standard, Bhattacharya has not only reported on but also shaped narratives around India’s economic policies and their political underpinnings. Today, he serves as the editorial director at Business Standard, wielding influence through his incisive columns and comprehensive analyses.

India’s Finance Ministers: From Independence to Emergency (1947-1977)

In his seminal work, "India’s Finance Ministers: From Independence to Emergency," A.K. Bhattacharya delves deep into the foundational years of independent India’s economic stewardship. Spanning the tenure from 1947 to 1977, A.K. Bhattacharya meticulously traces the evolution of India’s fiscal policies through the lens of its finance ministers. He highlights their struggles within political constraints, often conflicting with prime ministers and party ideologies. The book resonates with his central thesis: finance ministers operate in a politically charged environment where economic decisions intersect with partisan interests. His narrative draws from a rich tapestry of archival sources, Budget speeches, and personal insights, offering readers a nuanced understanding of how economic policies shaped India’s early years.

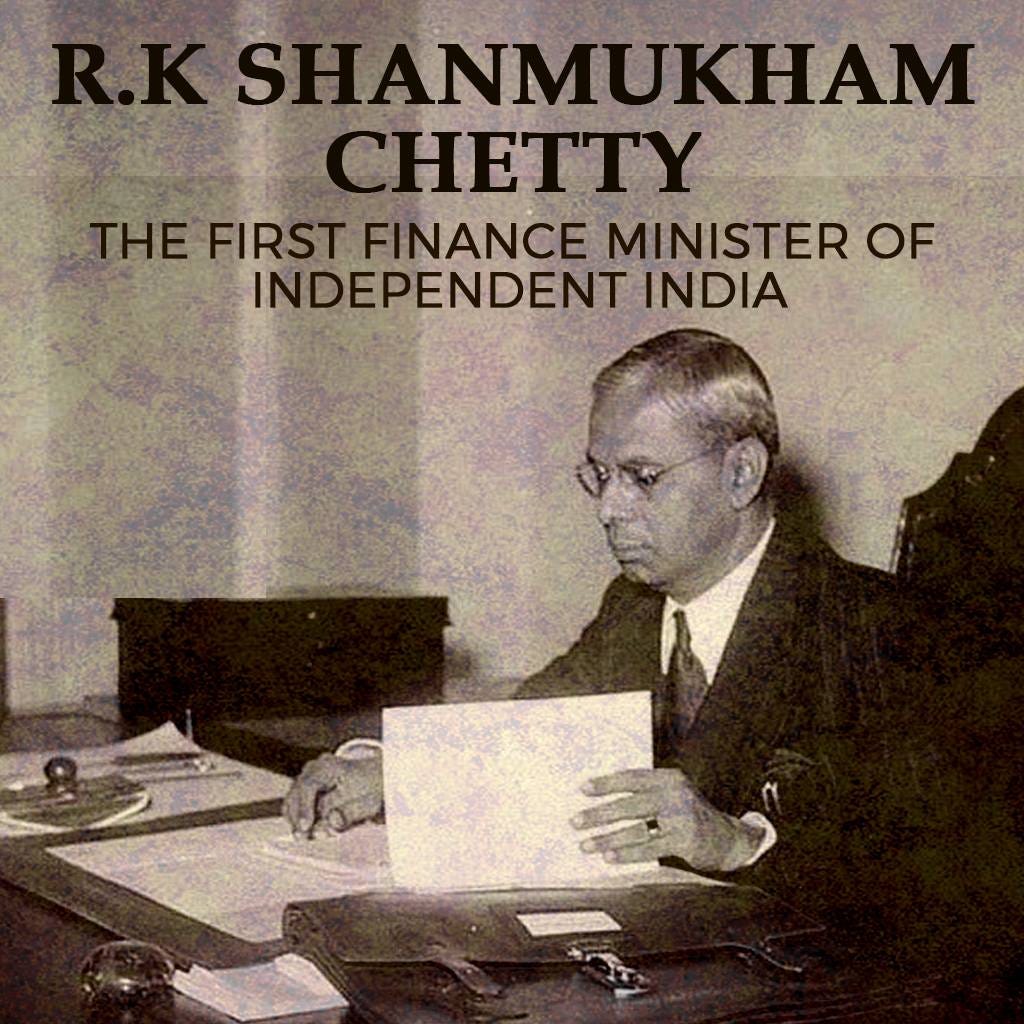

The book not only profiles key figures like R.K. Shanmukham Chetty and C.D. Deshmukh but also unpacks pivotal economic events such as currency reforms and fiscal strategies. The author’s approach is both scholarly and narrative-driven, providing readers with a comprehensive historical account while illuminating the intricate dynamics between economics and politics during India’s formative decades.

India's Finance Ministers: Stumbling into Reforms (1977 to 1998)

Continuing his exploration, A.K. Bhattacharya "India's Finance Ministers: Stumbling into Reforms" chronicles India’s economic landscape from the post-Emergency era to the late 1990s. This volume focuses on a period of profound economic flux marked by critical reforms and political upheavals. The author meticulously analyzes the roles of ten finance ministers and their impact on India’s shift from a closed agrarian economy to a liberalized one.

Central to this volume is the transformative tenure of Manmohan Singh, whose policies as finance minister under Prime Minister Narasimha Rao laid the groundwork for economic liberalization. The author scrutinizes the Budget speeches and policy decisions of Singh and his counterparts, offering readers a detailed account of how economic policies were shaped amidst political pressures. The book also sheds light on the complex interplay between finance ministers and prime ministers, illustrating how political dynamics often dictated economic agendas.

Through vivid anecdotes and scholarly analysis, A.K. Bhattacharya navigates through seminal events like the economic reforms of the 1980s and 1990s, the introduction of GST concepts, and the challenges faced during economic crises. His narrative skillfully weaves together political intrigue with economic policy, providing readers with a compelling narrative of India’s economic evolution during a transformative period.

A.K. Bhattacharya’s authoritative works stand as indispensable guides to understanding India’s economic history through the prism of its finance ministers. His meticulous research, combined with a narrative flair, not only educates but also captivates readers, offering profound insights into the complexities of economic policymaking in India. As he prepares for the third volume of his series, Mr. Bhattacharya continues to illuminate the past, present, and future of India’s economic stewardship, cementing his legacy as a foremost chronicler of India’s economic architects.

Excerpts from the Interview :

I. Motivation and Scope

Q) What inspired you to undertake the monumental task of chronicling India’s finance ministers from Independence to emergency?

AKB : The idea for this task came to me during one of my visits to the finance minister's office in North Block. I noticed a board in one corner of the large room, listing all the past finance ministers. Seeing that long list, I realized that the stories of these finance ministers would make for a fascinating read. What solidified my resolve was the realization that there was no comprehensive history—official or unofficial—of India's finance ministers and how they handled their budgets over the years.

Q) Could you elaborate on why you chose to divide the narrative into two volumes, spanning 1947-1977 and 1977-1998 respectively?

AKB : Initially, I had planned—quite foolishly, in retrospect—to write about these finance ministers in a single volume. However, soon after beginning my research, I realized it would take at least three volumes to adequately cover the work and budgets of finance ministers since Independence in 1947. Along with my publisher, Penguin, I decided to plan for three volumes: the first covering the 30-year period from 1947 to 1977, the second spanning 21 years from 1977 to 1998, and the third addressing the period after 1998.

Now, I realize that the third volume may well cover the period of 16 years from 1998 to 2014, paving the way for a fourth volume that could examine the finance ministers under Prime Minister Narendra Modi.

The period under study was divided this way because the first phase of 30 years was marked politically and economically by a certain kind of economic philosophy. Additionally, this entire period was ruled by the Congress. The second volume captures the slow beginning of the reform process, an unprecedented economic crisis, and the burst of reforms in 1991. The third volume will cover the coalition era under the BJP and the Congress, while the fourth volume will look at the finance ministers under Mr. Modi.

II. Research and Sources

Q) Can you walk us through your research process for these books? What were your primary sources of information?

AKB : My primary source was the budget speeches delivered by the finance ministers. The developments recounted in these budget speeches took me back to various archival materials and books at various libraries in Delhi. It required many weeks of work of just reading these reference books and biographical accounts of some of the finance ministers.

Q) Were there any particular challenges you faced while gathering information or verifying historical events for both volumes?

AKB : There weren’t too many details available on the first few finance ministers. Much of my work on them relied largely on their budgets and their own accounts of how they unveiled their policies. However, after the 1970s, accessing source materials for finance ministers from those decades was neither difficult nor challenging.

III. Narrative Approach

Q) How did you decide on the narrative style and structure for each volume? Did you face different challenges in presenting the pre-1977 and post-1977 periods?

AKB : I decided to be a narrator of events during the years under study, avoiding excessive subjective comments or observations. I believed this work should serve as a historical account of how the finance ministers handled their responsibilities. While I have made some comments about a few of the finance ministers, these remarks are primarily to provide historical context for the steps they took or the statements they made.

Q) Did you encounter any surprises or new insights about India’s economic history during your research?

AKB : There were many surprises and new insights. I would urge readers to go through them. I have tried to be a friendly narrator and placed most events in their historical contexts. The strained relationship between Morarji Desai and his prime minister, Jawaharlal Nehru, is widely known, but the degree of that distrust or doubt that Desai had for Nehru was a surprise. A new insight was the way Lal Bahadur Shastri managed to ease out his finance minister, TT Krishnamachari.

IV. Key Figures and Impact

Q) You’ve highlighted several finance ministers who left significant marks on India’s economy. Could you discuss a few who, in your opinion, had the most enduring impact?

AKB : Undoubtedly, the finance minister who made the most significant and enduring impact on the Indian economy was Manmohan Singh. He changed the course of Indian economic policymaking during the country’s worst economic crisis. He built a team of top technocrats to assist him in policymaking, which greatly benefited the government's economic reforms in the following decade.

Another finance minister who impressed me was V.P. Singh. He showed tremendous resolve to undertake reforms but got carried away by his desire to punish economic offenders through raids, ultimately losing the plot. Yashwant Sinha was an effective finance minister whose role in furthering the cause of indirect tax reforms is underappreciated. P. Chidambaram was also a focused finance minister who did not hesitate to implement important reforms in both direct and indirect taxes.

Q) How did these finance ministers navigate the intersection of economic policy and political pressures during their tenures?

AKB : Manmohan Singh understood the role of political economy in policymaking. Therefore, he made tactical compromises, such as agreeing to reduce the increase in fertilizer prices he had announced in one of his early budgets.

V. Political Context

Q)In Volume 1, you discuss the influence of socio-economic backgrounds on finance ministers’ decisions. How did this evolve over the years covered in Volume 2?

AKB : The socio-economic background changed significantly after 1978. Economic policy debates in the country became more reform-friendly, even though the actual implementation of reforms only occurred after the Indian economy was crippled by a major crisis in 1991. The Indian economy was opened up with liberalized trade, industrial, exchange control, and financial sector policies.

Q) Can you elaborate on the dynamics between finance ministers and Prime Ministers during periods of stable and unstable governments, as discussed in Volume 2?

AKB : In an unstable government with a fragile economy, finance ministers enjoy greater leeway in implementing bolder reforms with less resistance. Manmohan Singh's reforms were possible largely because of these factors. However, when the government is strong, as it was when Rajiv Gandhi was the Prime Minister in the mid-1980s, a reformist finance minister like V.P. Singh did not enjoy the same freedom. For political reasons, Singh was removed from the finance ministry in January 1987, barely a month before the budget was to be presented.

VI. Economic Reforms

Q) Volume 2 is titled “Stumbling into Reforms”. Could you explain why this title was chosen and how it reflects the narrative of that period?

AKB : These 21 years illustrate how reforms in 1991 occurred almost by accident and in response to an economic crisis. Between 1978 and 1991, finance ministers were attempting to reform economic policies but were slow in implementing their action plans. This sluggish pace led to the economy facing twin crises: fiscal indiscipline and a balance of payments problem. A political crisis further compounded the challenge. It was under these circumstances that Finance Minister Manmohan Singh introduced dramatic reforms in 1991. His successor, P. Chidambaram, continued with these reforms despite leading a coalition government that was not politically very strong. Hence, the title: "Stumbling into Reforms."

Q)What were the pivotal moments or decisions that shaped India’s transition from a closed, agrarian economy to a more liberal one during 1977-1998?

AKB : A combination of a worsening balance of payments, a widening fiscal deficit, rising debt, and a fragile government contributed to major economic reforms. These reforms set India on a new path toward higher growth, driven by both industry and services.

VII. Comparative Analysis

Q) How do the challenges faced by finance ministers in the two periods differ, especially in terms of economic ideologies and global influences?

AKB : The challenges varied significantly over time. In the first 30 years after Independence, the Indian economy was closed and faced a chronic foreign exchange problem. This forced finance ministers during this period to adopt measures that ushered in statism through nationalisation and state control of many economic activities. However, the 21 years after 1977 saw a gradual opening up of the Indian economy, with finance ministers progressively relaxing various economic laws. This period culminated in an unprecedented balance of payments and fiscal crisis, prompting the launch of major economic reforms in response.

Q)Were there any surprising parallels or contrasts between the finance ministers of the pre-1977 and post-1977 eras?

AKB : Finance ministers of the two eras were similar in that they had to largely follow their prime minister’s guidelines. When they differed with their prime minister, they soon paid the price with their job. This was true even in the post-1977 era. The big difference between the finance ministers of the two eras was that after 1977, finance ministers were able to implement many of their ideas, even when they were not fully endorsed by the prime minister. This was probably because the economy was not in the best health during this era, and finance ministers enjoyed more freedom in some respects.

VIII. Personalities and Policies:

Q) You mentioned the contrasting economic outlooks of figures like Nehru and Morarji Desai. How did these differing philosophies influence economic policy during their respective tenures?

AKB : During Nehru’s time, finance ministers took policy steps to realize their prime minister’s goal of achieving a socialistic pattern of growth. But under Morarji Desai, the finance minister allowed the private sector greater involvement in economic activities.

Q) Can you discuss how individual finance ministers balanced their personal beliefs with the economic needs of the nation, as portrayed in both volumes?

AKB : Finance ministers did not often get opportunities to reconcile their personal beliefs with the economic needs of the nation. They outlined policies that they believed were necessary for achieving higher economic growth.

IX. Crisis Management

Q) Volume 2 covers a period that includes economic crises like balance of payments issues. How did finance ministers of that time navigate such crises, and what were their key strategies?

AKB : The broad strategy was to open up the Indian economy, liberalize economic policies, scrap policies that constrained Indian industry's animal spirits (like the monopoly law), and reduce the role of the government in the running of businesses.

Q) Were there any instances where a finance minister's decisions significantly diverged from conventional economic wisdom, yet proved successful in hindsight?

AKB : None.

X. Legacy and Reflections

Q) Looking back at both volumes, what do you hope readers will take away about the role of finance ministers in shaping India’s economic trajectory?

AKB : I believe readers will understand the critical role finance ministers have played in India’s transformation as an economy during these years. Finance ministers may have to function within the policy parameters outlined by their prime minister, but they play a crucial role in generating ideas and proposals to address the country’s economic challenges.

Q) How have the legacies of these finance ministers influenced subsequent economic policies in India?

AKB : After the economic reforms of 1991, most finance ministers have largely followed the template of economic and fiscal policies that Manmohan Singh laid down in his first Budget for 1991-92. Finance ministers after him may have made marginal changes to the contours of those policies, but the broad trajectory has remained the same. However, recent years during the Narendra Modi regime have seen a reversal of tariff reforms with increases in import duties for many products. Despite this, the broad logic of economic reforms continues to be an article of faith for all finance ministers after Singh.

XI. Historical Context

Q) Volume 1 discusses the first thirty years after Independence. What were the defining economic challenges during this period, and how did finance ministers address them?

AKB : There were many challenges during those 30 years, but one of the most troubling issues stemmed from the scarcity of foreign exchange resources required to finance imports of goods and equipment for projects and industries in India. The foreign exchange shortage became so acute that India had to establish a permanent mechanism like the Aid India Club, which would provide foreign exchange assistance to India during those years.

Q) In Volume 2, what were the most notable economic transformations that set the stage for modern economic policies in India?

AKB : The major economic transformation was observed from 1991 to 1998, when all the major trade, industrial, and exchange control policies were liberalized. This significant development changed the course of the Indian economy, as captured in the second volume.

XII. Policy Evolution

Q) Throughout both volumes, how did India’s taxation policies evolve, and what were the key factors driving these changes?

AKB : In the years before 1991, taxes were used to raise revenues without recognizing the importance of improving revenue buoyancy. Consequently, taxes were unusually high. For instance, the income tax rate rose to over 97 per cent, import duties were excessively high, and indirect taxes like excise suffered from multiple rates. These issues with the taxation system began to change after 1991. Import tariffs were reduced, income tax rates were streamlined into three broad slabs, excise duties were rationalized, and corporation tax rates were lowered.

Q) Can you highlight any specific instances where finance ministers had to make unpopular decisions for the long-term benefit of the economy?

AKB : Finance ministers are often associated with making unpopular decisions. Manmohan Singh raised fertiliser prices, and although he had to scale back the proposed increase, he effectively initiated the process of reducing government subsidies on fertilisers, which had a beneficial long-term impact on the economy. The gift tax, introduced in the 1950s, was unpopular, but it served as a good measure aimed at preventing tax evasion.

XIII. Writing Process

Q) What was the most rewarding aspect of writing these books? Were there any anecdotes or stories that particularly stood out to you?

AKB : The most rewarding aspect of writing these books was that I got to learn about many new issues, developments, and debates concerning India’s finance ministers over the last seven decades or so. An anecdote worth recounting here is that after the first volume was released, I received a call from someone who said they liked my book. He identified himself as the grandson of one of the finance ministers I wrote about: John Matthai.

Q) How did you maintain objectivity while writing about such politically and economically charged topics?

AKB : That was fairly easy. My training as an economic journalist helped. I approached this project as an exercise in recounting the history of India’s finance ministers, knowing that I had to be objective to maintain credibility.

XIV. Audience Impact

Q) Who do you see as the primary audience for these books, and what do you hope they will gain from reading them?

AKB : Anyone interested in knowing and understanding how major economic policies were framed and implemented by finance ministers should be the primary audience for my books. Lessons from the past are crucial to comprehend the present and anticipate the future direction of the economy. Readers of such books can interpret the present with insights gained from historical perspectives.

Q) Have you received any surprising feedback or reactions from readers since the release of both volumes?

AKB : I was pleasantly surprised by a social media comment from India’s current Finance Minister, Ms. Nirmala Sitharaman, who found the book "extensively researched and well-written." Finance Secretary T.V. Somanathan said, "The book is so good that I think it actually functions almost like an official history of the Finance Ministry. However, it is different from an official history in that it is more objective than most official histories are."

XV. Future Directions

Q) You mentioned a third volume starting with the BJP’s governance. What can readers expect from this upcoming installment, and how do you plan to approach the recent economic history of India?

AKB : The third volume will cover the period during which four finance ministers — Yashwant Sinha, Jaswant Singh, Palaniappan Chidambaram, and Pranab Mukherjee — steered their respective governments’ economic policies from North Block, the headquarters of the finance ministry in New Delhi. This phase spans from 1998 to 2014, encompassing reforms, market controversies, and global economic crises that impacted India’s growth.

Q) Are there any other historical or economic topics you are considering exploring in your future writings?

AKB : I plan to write about how India’s political economy impacted the course of economic policymaking and reforms in the country.

Thank you all for reading and a big thanks to AKB for collaborating in today’s post!

It’s a pleasure!