Better , Simpler Strategy : An Interview with Felix Oberholzer — Gee (Professor @HBS)

FELIX OBERHOLZER — GEE is the Andreas Andresen Professor of Business Administration at Harvard Business School.

FELIX OBERHOLZER — GEE is the Andreas Andresen Professor of Business Administration at Harvard Business School.

Felix Oberholzer-Gee

Felix Oberholzer-Gee is the Andreas Andresen Professor of Business Administration in the Strategy Unit at Harvard…www.hbs.edu

An award-winning instructor , his academic work and consulting are focused on competitive strategy and the effects of digital technology on corporate performance. His research has been published in the very best peer — reviewed journals of his profession and profiled by media outlets around the world , including The Financial Times , The New York Times and The Wall Street Journal.

Oberholzer-Gee teaches competitive strategy in the HBS MBA program and in executive education course such as the General Management Program. He serves as a faculty chair of the Senior Executive Leadership Program for China and the Driving Digital Strategy program. He has held various leadership roles at Harvard Business School , including chair of the MBA program and Senior Associate Dean for the school’s global research centers.

He is cohost of the popular HBR Presents podcast After Hours. Among his happiest times are when he is cooking and eating (not necessarily in this order)

After Hours

HBR Presents Harvard professors discuss news at the crossroads of business and culture. About the hosts Youngme Moon is…hbr.org

Think of it as Professors in Cars Having Coffee

I've heard many ideas for reducing gun violence in the United States, but this was a new one on me. Mihir Desai, a…hbswk.hbs.ed

I had an insightful conversation and Q&A session with him in which he explained his theories and viewpoints to develop effective strategy that cuts through technological complexity and market uncertainties.

Better, Simpler Strategy: A Value-Based Guide to Exceptional Performance

Amazon.com: Better, Simpler Strategy: A Value-Based Guide to Exceptional Performance (9781633699694): Oberholzer-Gee…www.amazon.com

Excerpts from the Interview : -

Q1) I really enjoyed reading your book and the way you pioneered the research study on simpler strategy or value based strategy. I wanted to understand your process of crafting this book, research methodology, and its research objectives and hopefully gain some behind-the-scenes insights into your work.

Felix : So happy to hear that you are enjoying reading my book, Rishabh. What writer could make progress without close friends who patiently read early drafts and generously share insights? Through this book I wanted to share few insights which I have learned in conversations with executives directors and researchers in the HBS Global Initiative centers, MBA students from around the world , great teachers & extremely patient co-workers in the strategy unit at Harvard Business School. What I have learned in these conversations is that it is liberating to discover the simplicity in strategy. As if by magic , you see past inscrutable business jargon and incongruent frameworks.

All of the sudden , you understand how the very best companies achieve their exceptional performance and why many others fail to live up to their potential. This experience , the freedom that comes with clarity , is what I hope to share with the readers in this book. It is a book about the (financial) performance of companies . My goal is to provide readers either who have their own businesses or is working in a strategy division of a firm , a powerful yet simple way of thinking about business and the role of strategic management.

I believe that strategic management faces an attractive, back-to-basics opportunity. By simplifying strategy — by selecting fewer initiatives with greater impact — we can make it more powerful. In this book, I describe an easy-to-use framework called value-based strategy, which gives executives a common language for evaluating strategic initiatives and developing a holistic view of the many activities taking place within their organizations.

Q2) In the first line of your book, you say that strategy is simple. Not only the formulated strategy needs to be simple, also the way we generate it. We need simple frameworks and typologies that help us make sense of the world in a simple and easy way.

The need for simple strategies was always there, but, so the idea continues, it is even more pressing in today’s complex world. As some argue, yesterday’s world was simple enough to have complex strategies, but today’s world is so complex that our strategies need to be very simple and swift.

Do you agree?

Felix : In the past few decades , strategy has become increasingly sophisticated and complicated. The processes that companies install to develop their strategy are highly complex, hundreds of slides, dozens of analyses, many competing frameworks and considerations. I meet many managers who see strategic thinking as reserved for the most senior, most experienced executives.

There’s often this perception among younger generation that you need significant experience — gray hair and wrinkles — to think strategically. So one of the key messages in the book is that strategy is not complicated. There are only three levers: value for customers, value for employees, and value for suppliers. And the book shows how to operate these three levers.

I honed my approach to strategy in response to the challenges that I observed in the classroom and in my capacity as an adviser to companies. In my experience , value based strategy , the approach I describe in this book , is well suited to cutting through complexities and evaluating strategic initiatives. The framework provides a powerful tool that will allow you to see how your digital strategy is (or is not) related to your global ambitions, and how your marketing strategy is (or is not) consistent with the way you compete in the market for talent. Basically , value based strategy helps inform your decisions about where to focus and how to deepen your firm’s competitive advantage.

Q3) Value based Strategy helps businesses to know what and what not to do in order to stay focused in a volatile and complex world where the rate of change will never be slower than today , to be ready to give your customers a pleasant surprise. Companies that achieve enduring financial success create substantial value for all business stakeholders — customers, employees and suppliers. To make this easy to conceptualize, you have suggested the notion of a value stick.

Can you give our readers here an overview of a value stick framework?

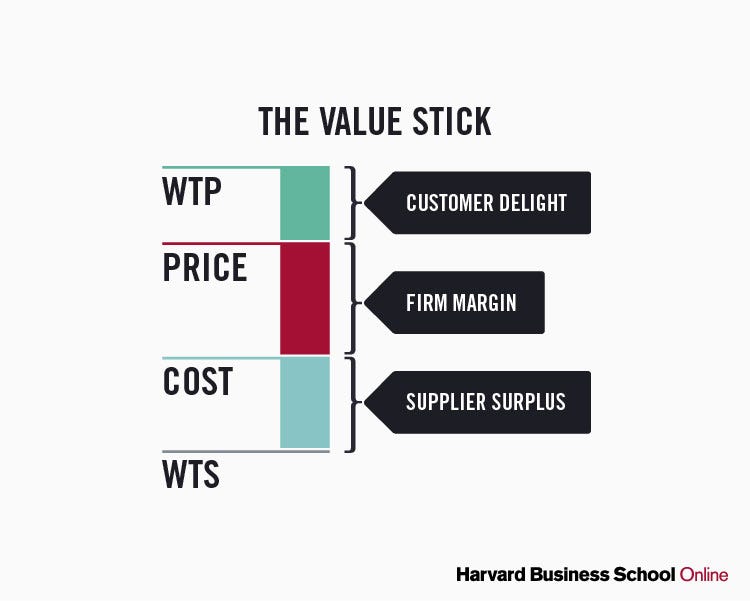

Felix : The value stick framework is a visual representation of a product’s value based on customers’ willingness to pay for it.

It has four components: willingness to pay, price, cost, and willingness to sell. Each of these components fall somewhere along the stick, and their locations determine the value of the product to the customer, supplier, and business.

Imagining each of these factors as sliders on a stick can allow you to test out different frameworks and help in strategic decision-making. If you lower the production cost, will the customer’s willingness to pay decrease? If you raise the production cost and price, will the customer’s willingness to pay increase? If so, is it worth it?

Comprehending the relationship between the supplier, business, and customer, and how each of them gains value from your product, is an important aspect during strategy formulation or implementation.

Firms that achieve sustainable financial success create substantial value for their customers, their employees, and their suppliers. . Therefore, a strategic initiative is worthwhile only if it does one of the following:

1) Creates value for people by increasing their willingness to pay (WTP): Too often, managers focus on top-line growth rather than on increasing willingness to pay. If a firms find ways to innovate or to improve existing products or services, customers will be willing to pay more. In many product categories, Apple gets to charge a price premium because the company raises the customers’ WTP by designing beautiful products that are easy to use. In casual conversations, we often use WTP and price interchangeably. But it is helpful to distinguish between the two. WTP is the most a customer would ever be willing to pay. Think of it as the customer’s walk-away point: Charge one cent more than someone’s WTP, and that person is better off not buying.

2) Creates value for employees by making work more appealing : When companies make work more interesting, motivating, and flexible, they are able to attract millennials and Gen Z talents who derive meaning from their work only if it creates any impact or difference in their respective community or society , even if they do not offer industry-leading compensation. Paying employees more is often the right thing to do, of course. But keep in mind that more-generous compensation does not create value in and of itself; it simply shifts resources from the business to the workforce. By contrast, offering better jobs not only creates value, it also lowers the minimum compensation that you have to offer to attract talent to your business, or what we call an employee’s willingness-to-sell (WTS) wage. Offer a prospective employee even a little less than her WTS, and she will reject your job offer; she is better off staying with her current firm. As is the case with prices and WTP, value-focused organizations never confuse compensation and WTS.

3) Creates value for suppliers by reducing their operating cost : Like employees, suppliers expect a minimum level of compensation for their product or services . A company creates value for its suppliers by helping them raise their productivity. As suppliers’ costs go down, the lowest price they would be willing to accept for their goods — what we call their willingness-to-sell (WTS) price — falls.

The goal is simple: get your customers to pay you more and your suppliers to charge you less

This idea is captured in a simple graph, called a value stick. WTP sits at the top and WTS at the bottom. When companies find ways to increase customer delight and increase employee satisfaction and supplier surplus (the difference between the price of goods and the lowest amount the supplier would be willing to accept for them), they expand the total amount of value created and position themselves for extraordinary financial performance.

Q4) According to your research on firm profitability : at one-quarter of the “firms included in the Standards and Poor’s 500 fail to earn long-term returns in excess of their cost of capital. In China that fraction is even higher, closer to one-third.

Why is that? What’s the key elements which is missing?

Felix : Do you tend to root for the underdog? If so, you will love the story about the ways Amazon gained a toehold in the market for consumer electronics in fierce competition with then-dominant Sony. Sony had it all: the best e-reader technology, a stellar brand in consumer electronics, and a marketing budget the size of a small country’s GDP. Amazon’s edge? A better way to think about value for customers.

Sales-driven organizations (like Sony) and companies that focus on willingness to pay, WTP (like Amazon) would show similar performance. But this intuition turned out to be wrong. Companies that train their lens on WTP have a significant long-term competitive advantage.

Some approaches to raising WTP are obvious: increase the quality of your products, enhance their brand image, innovate. But even strategies that are often overlooked can be exceptionally powerful. For instance, it is fascinating to observe how some companies leverage the power of complements: products and services whose presence raises the WTP for other products and services. If you compete on the basis of your products and services alone, you fail to recognize your complements, there is a good chance your business is already in trouble.

Strategies that lead to exceptional performance are built on three ideas: value for customers (raising WTP), value for employees and suppliers (reducing WTS), and increases in productivity (lowering cost and WTS). Building on this insight companies move from conceiving a strategy to putting it into practice. Observing brilliant strategists make three critical choices.

Q5) Geoffrey Moore found the exact same thing in his book “Dealing with Darwin.” In fact, he suggested that competing on cost/PRICE advantage no longer exists in the developed world. Businesses need to create meaningful differences in order to attain sustainable competitive advantage.

How do you think value-based strategy differs from conventional approaches?

I would emphasize two differences. First, we often think of strategy as answering two questions: Where do we play? How do we win? Many strategists consider the first question pre-eminent. I show in the book that for most companies, the best opportunities sit right in their industry, close to home.

Second, conventional strategic thinking teaches that companies can easily get “stuck in the middle,” with no discernible competitive advantage, unless they choose one of a limited number of strategic options such as cost leadership, differentiation, or focus. But the book is full of examples of companies that have dual and even triple advantages. The have an advantage in attracting talent and they charge customers a premium price. In fact, it is precisely because they create value for employees that they are then able to better serve their customers. This is particularly true in service industries.

Q6) What firms can do to increase their productivity , cost and willingness to sell(WTS) fall at one and the same time?

Felix : In the United States, leading companies are twice as productive as the weakest organizations. In emerging markets, top performers best the least efficient by a factor of five. Imagine — a company that produces five times as many products with exactly the same inputs! Whenever firms increase their productivity, cost and WTS fall at one and the same time.

If you wonder why JPMorgan Chase doubled in size after the Great Recession in 2008, when we were questioning if some financial institutions were “too big to fail,” look to economies of scale as one important reason. A classic in the strategist’s playbook, scale economies remain an influential means of lowering cost and WTS. And so is learning — the idea that costs decline with cumulative output. In fact, in the age of machine learning and advanced analytics, learning has become even more important. Anomaly detection algorithms, for instance, can result in substantial cost reductions because faulty parts are sorted out before they enter production workflows. While steeper learning curves promise considerable efficiency gains, the strategic effects of learning can be surprising. Consider the value of being the first to detect a better way of working. When everyone learns at the speed of light, being early means very little. Your competitors will catch up quickly. Paradoxically, the strategic effects of learning are most valuable if learning reduces cost at an intermediate pace — not too fast and not too slowly.

Scale and learning are on the evergreen list of productivity-enhancing strategies. And across many industries and countries, companies fail to adopt basic tools such as goal setting, performance tracking, and frequent feedback. If you are searching for ways to substantially raise the productivity of your team or your company, chances are these management techniques are among the most promising opportunities to raise your game.

Think value, and profits will follow. A value-focused company convinces its customers in every interaction that it has their best interests at heart.

Value-based strategy is uniquely suited to help us see a way forward. To make progress, value must sit at the very core of every business. Even the most vexing problems can bend when we apply enough creativity and imagination to create more value for customers, employees, and suppliers.

Thank you all for reading and a big thanks to Felix Oberholzer — Gee for collaborating in today’s post!

It’s a pleasure!